The number of people opting for a credit card in India is increasing. Various studies have revealed that there were around 8 million credit cards issued in India as of January 2018.

Nowadays, people have started to rely on a credit card to pay for smaller and bigger expenses. The most vital reason for them doing that is that they don’t need to pay the used limit instantly.

They can easily make a credit card bill payment after 40-50 days, and that gives them a lot of time to manage other expenses. Also, their idle amount in savings account keeps gaining the interest income as well till they pay the bill.

Talking about the credit card bill payment, it is vital to make the payment by the due date. Once your credit card statement is generated, you need to clear the dues by the due date in full or in minimum. Paying the credit card bills on time lets you keep your Credit Score higher to avail future loans at a lower interest rate.

Hence, credit card bill payment is necessary on time for healthy handling of the credit limit. If you are concerned about knowing some easy ways to make the credit card bill payment, here is a post that will help you. Read on!

Easy ways to make credit card bill payment

NEFT

NEFT stands for the National Electronic Fund Transfer. The system allows you to make a quick fund transaction. You need to have the active internet banking via which you can initiate the payment from your account to the credit card company. Many credit card holders opt for the NEFT mode for the credit card bill payment. All that you need to do is provide some payee details while using the NEFT facility such as:

- Payee name – credit card holder name

- Payee account number – the 16-digit number printed on the card

- Name of the lender

- IFSC Code

- Branch location

2. Mobile app payments

Nowadays, several leading finance companies come up with mobile apps. It helps a borrower to manage the account on his/her fingertips. Such apps can also help you check your credit card statement and even make the credit card bill payment.

Example – if you happen to be the Bajaj Finserv RBL Bank SuperCard holder, you have the freedom to use the RBL MyCard app to pay instant credit card bills quickly.

If you are using other bank credit card, you should download the respective bank app on your registered mobile number to start clearing the bill online.

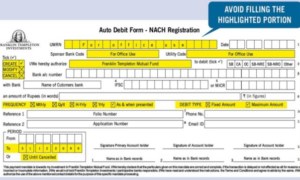

3. NACH

NACH means National Automated Clearing House. It is a centralized system that can easily handle periodic and repetitive financial transactions. It is easy to register with the NACH facility to the credit card bill payment automatic. All that you need to do is link your credit card account with your savings account at a bank. It is also possible via the internet banking facility of your savings bank account provider.

4. Cheque payment

If you don’t believe in making credit card bill payments online, you can still pay your credit card bill via the cheque payment method. In this case, you will need to issue the cheque payee to the lender and also mention the 16-digit credit card number. If needed, you may also include other vital details of your credit card account or personal details.

However, if you are going to make your credit card bill payment via using the cheque payment, then you need to do that sometime before your bill due date.

It is vital to consider as your cheque may take up to 2-3 business days to clear and for the amount to be adjusted into your credit limit. The ideal thing to do that is dropping a cheque at least 5-7 days before the bill’s due date to avoid late charges.

As you are now aware, paying your credit card bill after the credit card statement generation is quite simple and hassle-free. As per your needs and ease of use, you can choose a credit card bill payment method to pay it off quickly. This way, you can continue using it without landing into a debt trap and keeping the CIBIL Score high!

Lenders such as Bajaj Finserv presents some affordable and attractive pre-approved offers on credit cards, EMI finance, home loans, credit cards and other services. Such deals simplify your overall loan procedures and make it less time-consuming.

You can share some basic details like your name and mobile number to unlock your pre-approved loan deals today.

Leave a comment